Increasingly, Amazon invoice verification is being used to weed out FBA sellers who are using a retail arbitrage business model or buying from liquidators. One of the main reasons why your Plan of Action was rejected was that you did not submit proper invoices. I have previously highlighted the invoice requirements with respect to inauthentic complaints. However, I will go over the invoice requirements in greater detail.

Especially with new FBA accounts, Amazon will repeatedly ask for your invoices. They want to protect the integrity of their marketplace. Since there are many fakes on the Amazon platform, they need to determine which sellers have supply relationships with bona fide wholesalers or manufacturers. If you are a new seller, you are more likely to be asked to provide Amazon invoice verification. I find that most sellers are asked for invoice verification in their first six months of selling.

What is a proper invoice?

Amazon invoice verification will be used to investigate the supply chain, the invoice date must be issued within the last 365 days. Usually, Amazon is only interested in invoices issued within the last 180 days. Clearly, this can be a problem if you have aged inventory at Amazon.

Your invoice will include information such as your supplier’s name, email, phone number, address and website address. A proper invoice will list quantity, item description, the SKU, sizes, invoice number, shipment terms etc. It is especially important that the product descriptions are clear. Many Chinese sellers use images instead of product descriptions. Images will not be sufficient for invoice verification purposes.

It is extremely important that your invoice has your company name/address or the same name you have on file with Amazon. For example, if your FBA account is listed as “John’s Widgets,” your invoice should use the same name and should not use your personal name. The first thing that Amazon will check is whether the name on the invoice matches your name on file with Amazon.

Your invoice must include specific information. The direct phone number and email of your contact person. Your contact person should be a VP or a sales manager. You want to tell your contact that Amazon is in the process of verifying your business relationship. The supplier should be prepared for a call from Seller Performance.

Amazon is extremely suspicious of suppliers that do not have a bona fide website. I know that many Chinese sellers do not use a proper website. However, in 2022, Amazon wants to see a real website for your supplier.

What is NOT a proper invoice?

Amazon invoice verification sellers run into a lot of problems with invoices from Alibaba. These invoices do not list the seller’s contact information. Many times these invoices from China do not list an email or a website.

A pro forma invoice or an invoice where payment is still outstanding will not pass the documentation requirements at Amazon.

Retail receipts from stores such as Costco or Walmart will also not be deemed to be proper invoices.

Do Not Use Fake Invoices

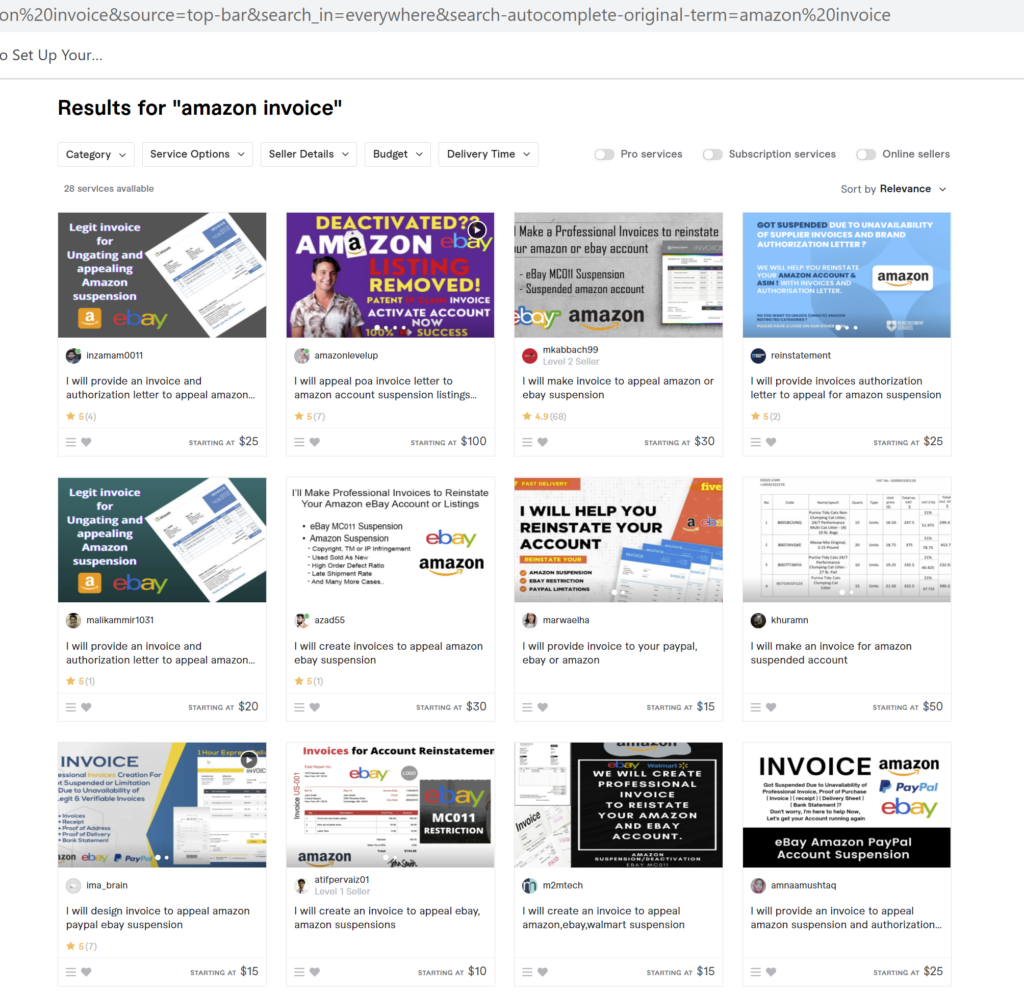

A lot of suspended sellers resort to fake invoices. Take a look at all the sellers on Fiverr selling fake invoices!

Commonly, Amazon FBA sellers buy products at liquidation and then Amazon requests to see wholesale invoices. However, liquidators cannot provide wholesale invoices that ensure the integrity of the supply chain. Subsequently, Amazon sellers resort to fake invoices. They either Photoshop the invoices or use a cheap service on Fiverr.

Amazon sellers will also use services such as Fiverr to obtain fake authorization letters as well.

The authorization letter or invoice might look professional. However, Amazon is skilled at detecting fake invoices. I have seen a number of sellers get caught using this method. First of all, Amazon is monitoring all invoices that come from unscrupulous sellers. Secondly, Amazon has programs and algorithms that can detect all types of forgeries. For example, for multiple accounts, Amazon is monitoring dozens of databases to find information that ties your name to a particular account. Yes, there are false positives. However, I am usually in awe at how quickly Amazon can detect bad behavior. Amazon will look for pixelated logos on the invoice or they will match colors from the supplier’s website to the invoice. If their document scanning program triggers further investigation they will then usually reject the invoice outright.

Do Not Alter Invoices To Pass Amazon Invoice Verification

Oftentimes a seller will want to alter an invoice. They might change an invoice in their personal name to their company name on file at Amazon. It seems like a relatively harmless change. However, Amazon will treat you as a dishonest seller if they detect any alterations.

You are allowed to black out pricing information and highlight your ASIN on the invoice. Other than that, do not make any changes to the Amazon invoice.

Have Your Invoices Reviewed

I have tried to outline all of their requirements for passing an invoice verification from Amazon. Contact us or call us at (888) 316-2856 if you are having difficulty reinstating your Amazon account or you are having problems with invoice verification.

One thought on “Amazon Invoice Verification”

Comments are closed.